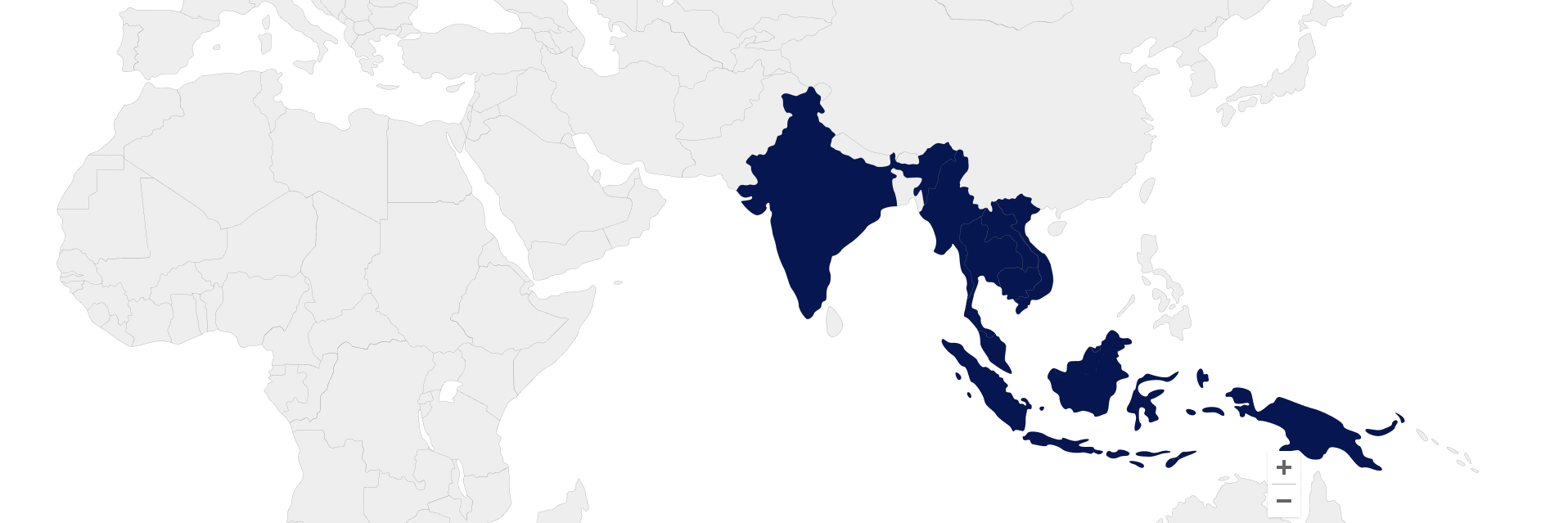

purus in south east asia

Fathoming The Most Dynamic Economies of the World

A Private Investment Fund Positioned in Sustainable &

Emerging Technologies and Concepts in India and South East Asia

PURUS

Purus Research in South East Asia

The economies of South East Asia have continued to be steadfastly resilient and delivered credible growth backed by an improvement in domestic and global demand.

Malaysia, the Philippines, Thailand and Vietnam are increasingly well-founded economic pillars of the global economy delivering stout opportunities in manufacturing, innovation and across the board advancement. Meanwhile, Indonesia with an inveterate pool of human capital and abundant natural deposits is progressively stimulating a stronger economic momentum. The onset of artificial intelligence, semiconductors and the fintech revolution among other technological furtherance’s are pivoted around Singapore. Growth drivers are nuanced in every Southeast Asian economy, a combination of strong consumption, output expansion, and higher exports, following an improvement in global demand, especially in electronics. Strong performance across services and manufacturing sectors are propping up the region’s economy.

The upcycle of global tech only stands to boost demand for electronics and consumer devices that will enable the continued momentum of the region’s export growth. Chemicals and commodities too find a strong footing in promoting greater economic output. The PMI of all economies in the region has sustained above the expansionary mark of 50.0. Global businesses continue to reassess and reconfigure their global operations and supply chain footprints, South East Asian economies are positioning themselves as an attractive investment destination. Currently, principal industries of Foreign Direct Investments (FDI) include automotive, electronics, mining and the services sectors.

Concurring with broader sentiments of the markets, industry leaders, economists and other analysts, Purus Research seeks to engage the highly prolific talent of the region to contribute to elevating its economic output and value to the global economy; in line with principles of sustainability to create a highly competitive and conducive ecosystem for advanced tech industries to thrive.

Lorem ipsum

Stakeholders

Lorem ipsum dolor sit amet consectetur.

Lorem ipsum dolor sit amet

Review our stakeholders’ profiles

Purus Research is a private investment fund. The Board collectively owns

50% of the stake in the fund, while 17, India-based high net worth individuals (HNWIs), hold the other 50% of the total capital.

Purus’s Investors are either business owners or executives at some of the most illustrious enterprises in healthcare, agriculture, engineering solutions, infrastructure, FMCGs, electronics and hospitality industries of India. Hence, availing us with a highly cherished reserve of business insights, proficiency and other material resources.Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Total Investments

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Cumulative Net

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Cumulative Net

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum

Region in Focus

India and South East Asia

GDP growth : 15%

Index of Industrial Production: 24%

FDI growth: 39%

Population: 23

Cumulative GDP Growth: 233

Cumulative CAGR of Industries in our Focus: 233

Lorem ipsum dolor

Business Segments

Healthcare

Energy

Agriculture

Engineering Solutions

Semiconductors

Artificial Intelligence

Follow our Research

An insight into the pieces that guide our investing philosophies and notions