Purus Pragati

Fathoming The Most Dynamic Economies of the World

A Private Investment Fund Positioned in Sustainable &

Emerging Technologies and Concepts in India and South East Asia

PURUS

Purus Pragati

Underpinning Pecuniary Support for the Success of Small Enterprises and Innovators in a Daedalian Delivery of Value to Imbue a Persisting Growth Spur

Purus ‘Pragati’ is a quotient of Purus Research’s overall investments that are availed to small and medium proprietorships and ventures predicated in industries of Purus’s focus. The pecuniary purveying is facilitated for entrepreneurs and organizations after a sedulous review of their business and pertinent intentions of upscaling the same.

In its first year, 2024, Purus Research has determined a total amount of INR 45 lacs ($53,810) for Purus Pragati, which is 15% of our initial investments for FY 2024-25.

Nationals of India, Brunei, Cambodia, Timor-Leste, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam can procure financial aid for their businesses in the industries of agriculture, healthcare, engineering solutions, renewable energy, semiconductors and artificial intelligence by applying here.

Purus Pragati is central to the fruition of our larger vision and aims, however, in the initial years, the investments made in real terms through the fund are circumscribed. We are earnestly committed to proliferating total investments through Purus Pragati year-on-year.

If for a particular financial year, Purus Pragati grants are already awarded then the application page would cease to exist until the fund’s replenishing in the following fiscal year.

Due to the aforementioned inhibitions in Purus Pragati’s extent for the initial years, the board has determined to award only one to a maximum of three separate grants in FY 2024-25. Hence, a cutthroat competition ensues.

Lorem ipsum

Stakeholders

Lorem ipsum dolor sit amet consectetur.

Lorem ipsum dolor sit amet

Review our stakeholders’ profiles

Purus Research is a private investment fund. The Board collectively owns

50% of the stake in the fund, while 17, India-based high net worth individuals (HNWIs), hold the other 50% of the total capital.

Purus’s Investors are either business owners or executives at some of the most illustrious enterprises in healthcare, agriculture, engineering solutions, infrastructure, FMCGs, electronics and hospitality industries of India. Hence, availing us with a highly cherished reserve of business insights, proficiency and other material resources.Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Total Investments

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Cumulative Net

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Cumulative Net

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum

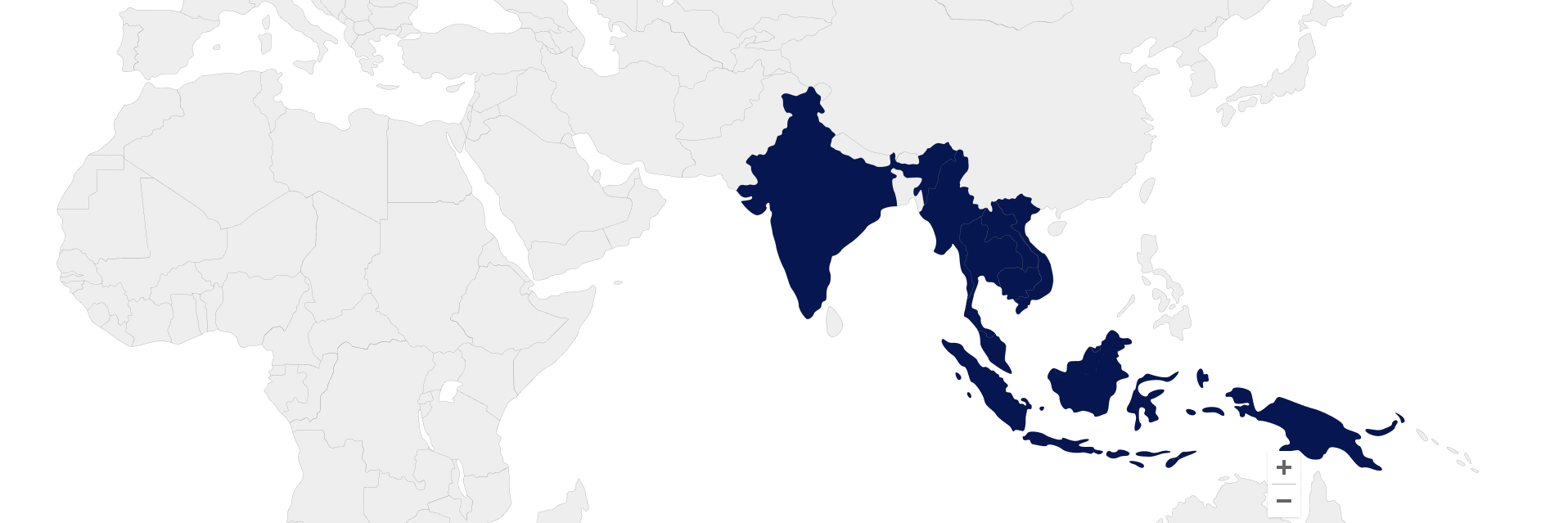

Region in Focus

India and South East Asia

GDP growth : 15%

Index of Industrial Production: 24%

FDI growth: 39%

Population: 23

Cumulative GDP Growth: 233

Cumulative CAGR of Industries in our Focus: 233

Lorem ipsum dolor

Business Segments

Healthcare

Energy

Agriculture

Engineering Solutions

Semiconductors

Artificial Intelligence

Follow our Research

An insight into the pieces that guide our investing philosophies and notions